The Quint Land

Acquisition Group

Investment Opportunity: Land Acquisition & Entitlement Flip Near Intel, Facebook and Microsoft.

What Is The Quint Land Acquisition Group?

Perhaps the most epic real estate story of the decade.

We focus on capital preservation and risk mitigation, while still having great upside potential.

This Area Is Set To Boom – Get Early Access Now

If you are an accredited investor, you can own swiftly appreciating land value as a neighbor to massive hi-tech development.

Learn more about our investor criteria here.

Why Columbus, Ohio?

-

Housing Shortage

Estimates show a shortage of 40,000 housing units today.

-

Population Growth

The local population in and around Columbus is set to double by 2035.

-

Big Tech Moving In

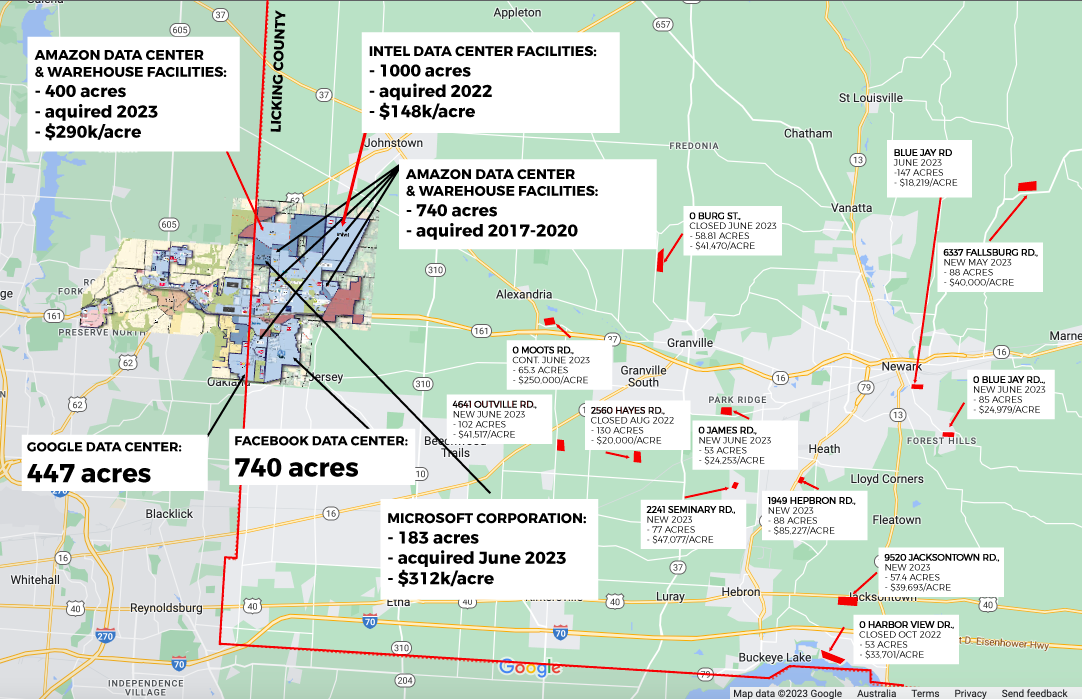

Google, Microsoft, Meta (formally Facebook), and Intel have all purchased big acreage in Columbus.

Under The Radar Land Grabs

Very quietly, over recent months, massive land purchases have been made to develop a local “Silicon Valley” construction bonanza by companies including:

-

447 acres purchased for Data Center

-

183 Acres purchased

-

400 acres purchased for Data Center and Warehouse Facilities. PLUS, 740 additional acres purchased.

-

1000 acres purchased for Data Center Facility.

These high-tech behemoths - along with LG and Honda - are slated to build enormous hi-tech parks, which, as they are constructed, will draw an enormous young professional population influx - and drive up land values as well as the need for local housing.

Investment Strategy - Phase I

Location: 30 miles from the tech park

Land Size: 500+ acre parcel

Current Market Value: $14million

After Entitlement Value: $101million

Target Raise: $15 million

Targeted Estimated Bridge Loan

Investment Return *

Holding Period Return

106%

Annualized Compound Return

44.6%

Average Annualized Return

55.4%

IRR

44.6%

* Based on 2-year Note.

Ready To Learn More?

Schedule a call with our team at your convenience.

Learn more about our investor criteria here.

Understanding The Benefits

of Investing In A Land Acquisition

1

Spreads out investor equity over multiple acquisitions.

2

Greater exposure to investments in various markets and asset classes.

3

Provides the opportunity to participate in upside on land price appreciation upon sale, refinances, and supplemental loans.

4

Provides multiple exit opportunities based on the individual investors goals.

5

Diversification offers the ability to reduce risks while offering the potential for higher returns.

6

Potential tax benefits for investors such as pass-through depreciation opportunities and 1031 exchanges

Your investment helps make this a reality.

Let’s do this

To book a time to speak to our team, please fill out the form below, along with the investor accedidation form and return to us at your earliest convenience.